“We’ve been in a low-interest rate environment and that’s changing. “We’re in the process of a regime change,” says Sandven.

Bank Wealth Management, calling February a wait-and-see month. Investors will spend the month of February digesting earnings results from the final quarter of 2021 and assessing whether the pace of inflation will be transitory or sustained at current levels, notes Terry Sandven, chief equity strategist at U.S. The Federal Reserve has sketched out its plans to tighten monetary policy and curb inflation, but market participants worry the Fed won’t be able to pull that off without damaging the economy.Īt the January FOMC meeting, Fed Chair Jerome Powell said central bankers could raise the federal funds rate as soon as the next meeting in March. While geopolitical tensions between Russia and Ukraine and earnings season added to the volatility, there’s no doubt about the main culprit. That’s a far cry from last year, when all three of the leading U.S. The Nasdaq Composite Index approached bear market territory-at its worst, the tech-heavy index was down nearly 17% from its November high. The S&P 500 flirted with a market correction, falling at one point as much as 9.8% from the prior all-time high. stock market finally succumbed to the pullback that many had been forecasting throughout the latter half of 2021. The benchmark index fell at least 1% on six different trading days during the month of January it fell by this magnitude just 21 times in all of 2021.

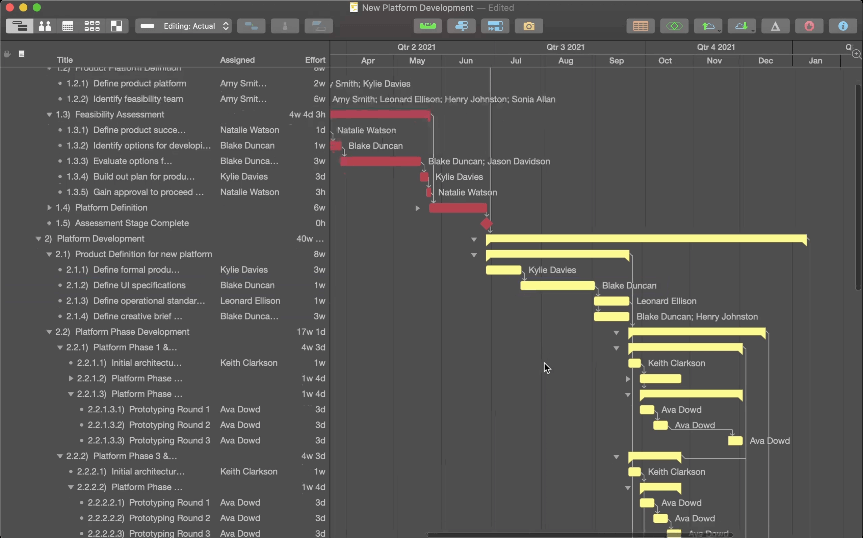

Best planning tools for mac outlook series#

But this year, January was merely volatile-the S&P 500 roared into the year at an all-time high and limped into February down 5.3%, following a string of sessions that saw a series of remarkable intraday reversals. January, they say, is the cruelest month.

0 kommentar(er)

0 kommentar(er)